Precision Financial Calculator

Precision Financial Calculator Precision Financial Calculator

Precision Financial CalculatorContinue from Example 3-1. With the new interest rate of 7.125%, Mrs. Gibson estimates that she can have the additional money of $45,000 to pay off the loan at the beginning of the third year (the 25th month). How many months can she shorten the loan payment? How much interest can be saved? Verify the total principal paid from the amortization table. If she decides to pay $300 each month for the additional principal payments starting from the third year, what the situation would be?

[Answer: 73 months, $45,246.54]

[Procedures]

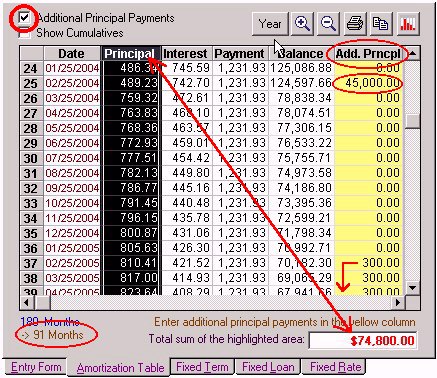

On the Loan calculation tab, type in 136,000 for the loan amount, 180 for the number of the months, 7.125 for the interest rate. Click the Calc button, you get the monthly payment of $1231.93. The payment schedule will be displayed on the Amortization Table tab. Select the Additional Principal Payments check box. The Additional Principal Payments will show at the last column. Type in 45,000 for the additional amount to pay off at the 25th row on this column and hit Enter key. You will get the new number of payment months 107. Click on the Interest column title bar. The Interest column is highlighted. The total interest paid is $40,500.93. Compared with the original total interest $85,747.47, she saves $45,246.54. You can see the numbers from the summary chart by clicking on the chart button. Again, click on the Principal column title bar to get the total principal paid is $91,000. The sum of this number and $45,000 is $136,000.

Enter 300 to the 37th row on the Additional Principal Payments column and press Enter key. Click on this cell. Point the mouse pointer to the lower right corner of this highlighted cell, you will see the pointer icon change to cross-hair. Now drag this cross hair all the way down to the end row. You will see the term reduces to 91 months and the total interest paid reduces to $36,623.73. If you want to verify the total principal to be $136,000, take off the last additional principal payment $300 since you do not pay this amount at the end.